If you only ever read one book about how to handle your own money it should be this one.

I’ve read several books on the subject and Money covers everything without mind numbing figures.

Tony interviewed the best investors and boiled down their knowledge for the rest of us. This book should cost thousands of dollars for the value it will give over time if you invest the way it describes. But it doesn’t and Tony is giving away all the profit to 100 Million Meals Challenge, each book sale will provide 50 meals to people in need!

One big nugget I’ll share is, right now choose how much of your take home money you will set aside to invest, every paycheck. You can probably automate that through your employer or bank once you do decide so you don’t have to think about it again.

Take Theodore Johnson, a UPS worker when they first started in 1924. He never made more than $14k/year, but he put 20% of his paycheck and every Christmas bonus into company stock. When he was 90 years old he had $70 million.

At the very least go to Vanguard and start making automatic deposits into an index fund.

From 1984 to 1998, a full 15 years, only eight out of 200 fund managers beat the Vanguard 500 Index. That’s less than 4% odds that you pick a winner (that’s worse odds than expecting blackjack if you hit with two face cards, that’s an 8% chance!).

The secret to wealth is simple: Find a way to do more for others than anyone else does. Become more valuable. Do more. Give more. Be more. Serve more. And you will have the opportunity to earn more.

The secret of getting ahead is getting started.

It’s not what you earn, it’s what you keep that matters.

48% of all working Americans haven’t even calculated how much money they’ll need to retire.

Stocks are 3 times more risky (aka volatile) than bonds… by having a fifty-fifty portfolio, you really have more like ninety-five percent of your risk in stocks!

This boxing analogy is for all those businesses out there who don’t quite have a handle on social media. It gives a breakdown of each platform and, my favorite part, critiques of brand’s posts that failed and succeeded.

You owe it to your business to get a handle on these platforms and use them effectively. Many of the concepts in this book are ones I’m incredibly excited about. I completely agree with Chapter 10: All Companies Are Media Companies.

The secret sauce remains the same: The incredible brand awareness and bottom-line profits achievable through social media marketing require hustle, heart, sincerity, constant engagement, long-term commitment, and most of all, artful and strategic storytelling.

One in four people say they use social media sites to inform their purchasing decisions.

One out of every five page views in the United States is on Facebook.

Information is cheap and plentiful; information wrapped in a story, however, is special.

Retweeting fan praise is a mistake that thousands of brands make every day. Retweets of this nature have little to no value to anyone who follows you.

A story is at its best when it’s not intrusive, when it brings value to a platform’s consumers, and when it fits in as a natural step along the customer’s path to making a purchase.

Get inside billionaire’s heads and see what makes them successful. This isn’t a get-rich-quick book, it’s a study of success. Incredible success.

It’s hard to even fathom one billion anything. Do you know how long ago was one million seconds? That’s 11 days ago. Now can you imagine when one billion seconds ago was? That was 32 years ago.

Reading a book like this helps cultivate a mindset conducive to massive action. However, one of my most favorite points this book hits on, is destroying the myth that all billionaire entrepreneurs must be huge risk takers.

Also the distinction that is made between producer and performer will help anyone recognize the difference and manage employees better and figure out which one you are and use it to your advantage.

Cultivating a balance of judgement and vision is a challenging task. Findings from neuroscience suggest that for most people, judgement and imagination sit on opposite ends of a mental spectrum. The more skill one is at seeing things as they are (judgement) the harder it is to see things as they might be (imagination).

For more than 70 percent of the sample, the idea or transition that catapulted them to billion-dollar success happened after age 30.

More than 80 percent of our sample of self-made billionaires earned their billions in red oceans – highly competitive, mature industries.

Our research shows that Producers generate ideas through a mode of creativity known as divergent thinking. Divergent thinking involves the free flow of different ideas and associations for the purpose of identifying solutions to a problem.

(this same concept is in another book too – The Future of the Mind)

Reading was the most popular method used by billionaires to get inspiration.

Reading was the most popular method used by billionaires to get inspiration.

The real risk is losing the opportunity, not failing in the attempt.

The practice of punishing failure discourages leaders from taking the kinds of relative risks that can pay off, and it destroys the organization’s ability to take advantage of that leader’s resilience and apply her lessons to new ventures in the future.

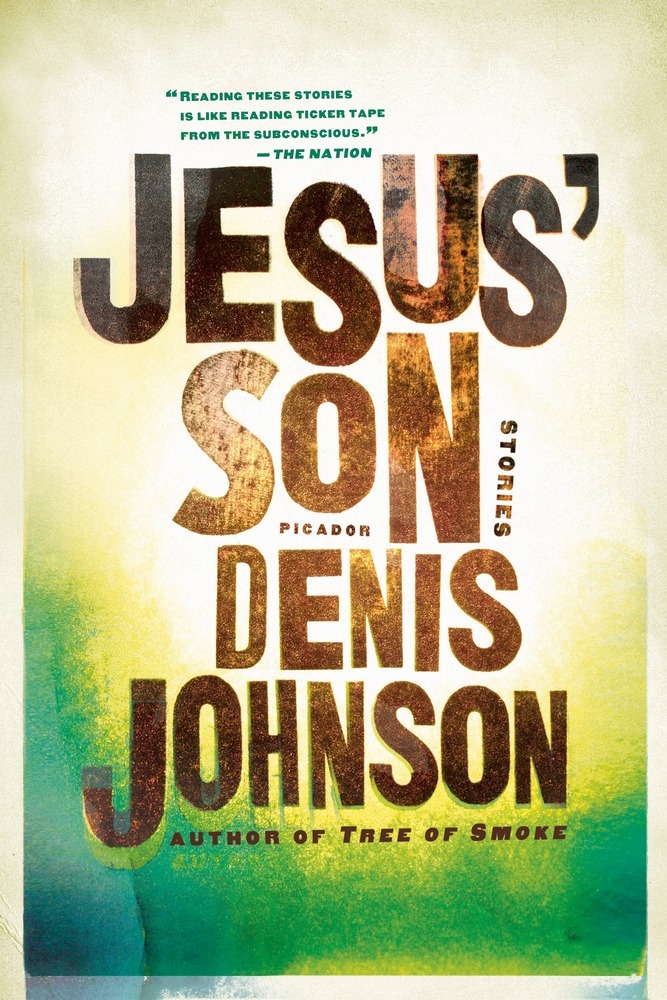

This is not a book about Jesus’ son. It’s not a religious book at all.

It’s a collection of fictional short stories with a stream of consciousness writing style.

If the other three books listed here are the meat and potatoes, this book would be the weird after dinner drink your host serves because they bought a bottle of it on vacation and it gives a weird kick to your palate at the end of a meal. I’m thinking of the french drink pastis.

Anyways, it’s hard to pull quotes from fictional books like this one.

“Exhilarating … these stories have appropriately enigmatic shapes, but they’re built to last”

– Newsweek

“These tales are told with apparent carelessness, a kind of grinding realism which would suggest that these events are as purposeless as they seem. But at heart Johnson is a metaphysician, and through the luminous windows that startlingly open in the deadpan prose … we are bystanders to an act of testimony.”

– USA Today